Dear Kingdom Builder,

Catchy title, right?

But believe it or not, it’s straight out of Scripture.

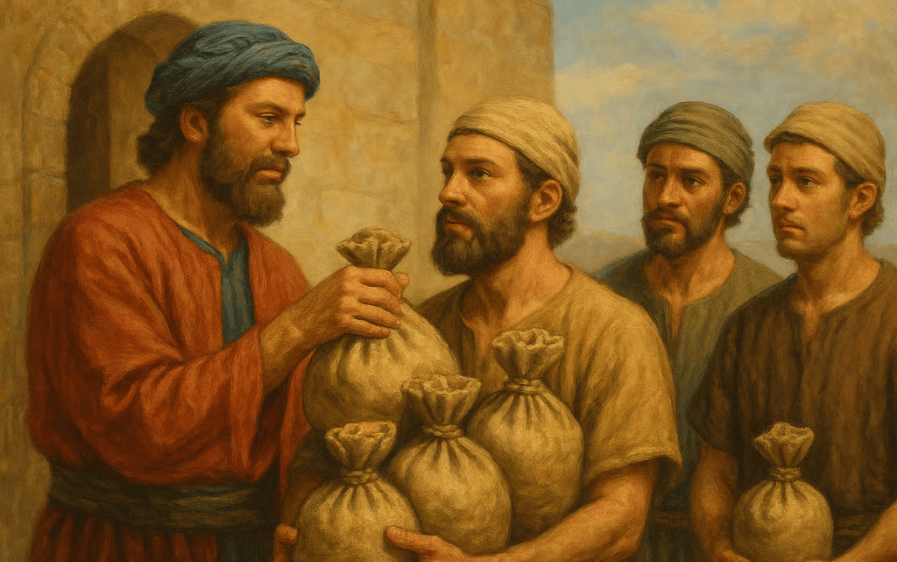

In Matthew 25, Jesus tells the Parable of the Talents — a story about a wealthy master who entrusts his servants with bags of gold before leaving on a long journey. One gets five bags, another two, and the last one only one.

When the master returns, the servant who received five bags proudly announces,

“Master, you entrusted me with five bags of gold. See, I have gained five more.”

He doubled his money — a 100% return.

How did he do it? The Bible says he “put the money to work.” Some versions of the Bible say he invested it. Not timidly or fearfully, but boldly and faithfully — trusting that what was entrusted to him was meant to grow.

The master’s reply is one of the most affirming lines in all of Scripture:

“Well done, good and faithful servant! You have been faithful with a few things; I will put you in charge of many things.”

That’s not just a parable about spiritual stewardship. It’s also a principle for financial stewardship. God expects us to multiply what He places in our hands — not just bury it for safekeeping.

So, how do we do that in today’s world of inflation, market noise, and endless financial confusion?

One of the most straightforward and most effective answers, in my opinion, is found in a single investment: The S&P 500.

What makes the S&P 500 so special?

Think of it as owning a tiny piece of the 500 most successful, innovative, and influential companies in America — the very businesses driving our economy forward. Companies like Apple, Amazon, Microsoft, and hundreds more.

To even qualify, a company has to be U.S.-based, worth at least $15 billion, and consistently profitable. In other words — no slackers allowed.

But there’s more happening behind the scenes than most people realize.

A Secret Committee Picks the Winners

S&P stands for Standard & Poor’s, a financial research company that built the index. Behind it is a secret committee that decides which companies make it in … and which ones get kicked out.

Sounds mysterious, doesn’t it? But it’s actually brilliant. Keeping the members anonymous prevents lobbying and ensures the index stays fair.

The Index Is Constantly Upgrading

Each year, around 25 companies are swapped out. The weak are removed, and the strong are added.

That’s like having a built-in investment manager who automatically weeds out losers and replaces them with winners — all without you lifting a finger.

Because here’s a sobering fact: over time, about half of all individual stocks actually go down in value. But by owning the S&P 500, you let the secret committee do the work of choosing which ones to keep.

The Heavyweights Pull the Load

When you invest in the S&P 500, you’re not putting an equal amount into every company. The top five — currently Meta, Amazon, Apple, Microsoft, and Nvidia — make up roughly 27% of the index.

And that’s a good thing. You want the strongest companies carrying the most weight. Ten years ago, it was Exxon and General Electric at the top. Times change, but the S&P 500 always adjusts to favor strength and innovation.

It’s Incredibly Tax-Efficient

If you sell a stock for a profit, you owe Uncle Sam 15–40%. But S&P 500 ETFs are structured with a clever “in-kind creation and redemption” system that lets them trade stocks without triggering taxable events.

And if you invest through a Roth IRA, your profits grow completely tax-free.

Even better? When your heirs inherit shares, their cost basis “steps up” to the current market value — meaning they can sell without owing a dime in taxes on your gains.

That’s not just smart investing — that’s generational stewardship.

A Compounding Machine

For these reasons, the S&P 500 is one of the best places to put your money.

It is far better than gold, real estate, and bonds.

Take a look at the chart below for proof …

Please look at the returns of $100 closely.

Cash (money markets and CDs) would turn into about $3,000.

Real Estate (unleveraged) would turn into $7,000.

Bonds … $8,000.

Gold … $10,000.

The S&P 500 … about $1,000,000.

That’s not a typo. That’s the miracle of long-term compounding. At roughly 10% average annual growth, your money doubles every eight years.

So if you invested $1,000 today, in eight years it could become $2,000 … a 100% return — just like the faithful servant.

How to Get Started

Step 1: Open an account with a major financial firm like Vanguard, Fidelity, or Schwab.

They make it simple — you can be set up in minutes.

Step 2: Choose one of these funds:

Vanguard S&P 500 ETF (VOO) — Expense ratio: 0.03%

Fidelity 500 Index (FXAIX) — Expense ratio: 0.02%

Schwab S&P 500 Index (SWPPX) — Expense ratio: 0.02%

Step 3: Automate your contributions.

Whether it’s $50 or $500 a month, set it to invest automatically on payday. You’ll never miss the money — but you’ll definitely notice the growth.

Faithful Stewardship in Modern Form

Investing wisely isn’t about greed — it’s about faithfulness.

It’s about taking what God has entrusted to you and multiplying it for His Kingdom.

The servant in Jesus’s parable didn’t gamble or speculate. He simply made bold, consistent, compounding choices that honored his master.

When you invest in something like the S&P 500, you’re doing the same thing — letting your resources grow through time, innovation, and discipline.

So when you invest faithfully and patiently, you’re not just building wealth.

You’re saying, “Lord, I will be faithful with what You’ve placed in my hands.”

And that, in the truest sense, is how we turn five bags into ten.

If you’d like more insight on how to build Kingdom-minded prosperity, I invite you to watch my presentation titled Abundant Prosperity. Click here to watch now.

For His Kingdom,

Aaron DeHoog

Founder & 49% Owner, Abundant Prosperity